You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TheSloth

The Slowest One

Its good to see the on going discussion! As a newbie here, I am learning lot of things.

I have question regarding this long term investments in ELSS/Direct MFs. Is it really safe for long term? How much percentage of total savings will be better and safer bet in this case.

How does it fair against NPS or FDs. I am watching some videos on youtube, suggestion was to go for FDs for short term(<=5 years) where one knows that the cash will be needed within this time for sure. If its long term, better to go ELSS/Other MFs. Can we consider this as general idea and follow or there are any other risks to considered?

Another question I have is, say I am investing in MFs through SIP. How fast I can withdraw cash in case of emergencies?

I have question regarding this long term investments in ELSS/Direct MFs. Is it really safe for long term? How much percentage of total savings will be better and safer bet in this case.

How does it fair against NPS or FDs. I am watching some videos on youtube, suggestion was to go for FDs for short term(<=5 years) where one knows that the cash will be needed within this time for sure. If its long term, better to go ELSS/Other MFs. Can we consider this as general idea and follow or there are any other risks to considered?

Another question I have is, say I am investing in MFs through SIP. How fast I can withdraw cash in case of emergencies?

rockfella

Ambassador of Buzz

It is very safe for LONG TERM ONLY. Whatever MF you do think in terms of 7 years minimum.Its good to see the on going discussion! As a newbie here, I am learning lot of things.

I have question regarding this long term investments in ELSS/Direct MFs. Is it really safe for long term? How much percentage of total savings will be better and safer bet in this case.

How does it fair against NPS or FDs. I am watching some videos on youtube, suggestion was to go for FDs for short term(<=5 years) where one knows that the cash will be needed within this time for sure. If its long term, better to go ELSS/Other MFs. Can we consider this as general idea and follow or there are any other risks to considered?

Another question I have is, say I am investing in MFs through SIP. How fast I can withdraw cash in case of emergencies?

Cash withdraw takes about 7 days. Faster in liquid funds. Since FDs are indirectly related to the economy investing in FDs never makes sense. They will charge you high % on the interest you earn on FD as well. IMHO it is a scam lol.

Last edited:

TheSloth

The Slowest One

What is that 30% charge ? Didn't read about it until now.It is very safe for LONG TERM ONLY. Whatever MF you do think in terms of 7 years minimum.

Cash withdraw takes about 7 days. Faster in liquid funds. Since FDs are indirectly related to the economy investing in FDs never makes sense. They will charge you 30% on the interest you earn on FD as well. IMHO it is a scam lol.

Oh man! I didn't get updates from this thread in my feed, weird.

I am glad this thread picked up!

My investments done in July last year, are up more than 20% due to the inflated market right now. So needless to say I am regretting not investing more at that time.

Also, my small investments done in trading, gave me good amounts of losses too! Which I consider a fees paid to market, and right now not doing any trading.

Also applying in majority of IPOs from August, and got one too (Mazdock), which gave me good 40% listing gain! Invest Aaj for kal and Finology are good YTbers which I am following to get my insights.

Now I am trying to wait for the dip in the market to reenter, but not sure when it's going to be!

I am glad this thread picked up!

My investments done in July last year, are up more than 20% due to the inflated market right now. So needless to say I am regretting not investing more at that time.

Also, my small investments done in trading, gave me good amounts of losses too! Which I consider a fees paid to market, and right now not doing any trading.

Also applying in majority of IPOs from August, and got one too (Mazdock), which gave me good 40% listing gain! Invest Aaj for kal and Finology are good YTbers which I am following to get my insights.

Now I am trying to wait for the dip in the market to reenter, but not sure when it's going to be!

sling-shot

Wise Old Owl

Probably refers to the income tax chargeable on interest.What is that 30% charge ? Didn't read about it until now.

I think it will last for at least a year or two as IDFC is still too small scale.Do you think this will remain 7 % for long, DBS used to offer same but it has now fallen..

Good large cap MF are safe in the long term(in fact safer than many banks as some banks have failed but never a good large cap mf). NPS is your retirement benefit provided by the employer & an opportunity to save tax under 80C exemption. FD is not recommended for non-senior citizens who are not looking to park their life savings, keep some amount in FD if you are getting good interest much higher than savings acc else it is useless.Its good to see the on going discussion! As a newbie here, I am learning lot of things.

I have question regarding this long term investments in ELSS/Direct MFs. Is it really safe for long term? How much percentage of total savings will be better and safer bet in this case.

How does it fair against NPS or FDs. I am watching some videos on youtube, suggestion was to go for FDs for short term(<=5 years) where one knows that the cash will be needed within this time for sure. If its long term, better to go ELSS/Other MFs. Can we consider this as general idea and follow or there are any other risks to considered?

Another question I have is, say I am investing in MFs through SIP. How fast I can withdraw cash in case of emergencies?

All interest income generated from fd/rd is taxable at your current income tax slab so if you are in 30% tax slab then you will have to pay 30% tax(in fact a bit more after incl cess) on all interest income from fd/rd.What is that 30% charge ? Didn't read about it until now.

Welcome to the club! Unless one loses some good amount of money in the market first he will never make money in the market later either.Also, my small investments done in trading, gave me good amounts of losses too! Which I consider a fees paid to market, and right now not doing any trading.

IPOs nowadays may seem like easy money but don't get misled, good IPOs are always in minority & it also depends on current market situation. Take a good look at burger king ipo price chart after its listing where many lost heavily despite having the chance to make a good profit. Remember when you are directly dealing in equities then you are effectively competing against the likes of Mukesh Ambani & Jhunjhunwala, there is a good reason why you have heard of many people making lakhs in share market but never many millionaire/billionaire investors like Jhunjhunwala. I have seen guys on forums earning 50-60k within few weeks & then losing similar amount in few hours so at the end of the year they are still at the same place or just a bit better financially while still holding their regular job.Also applying in majority of IPOs from August, and got one too (Mazdock), which gave me good 40% listing gain! Invest Aaj for kal and Finology are good YTbers which I am following to get my insights.

IPOs nowadays may seem like easy money but don't get misled, good IPOs are always in minority & it also depends on current market situation. Take a good look at burger king ipo price chart after its listing where many lost heavily despite having the chance to make a good profit. Remember when you are directly dealing in equities then you are effectively competing against the likes of Mukesh Ambani & Jhunjhunwala, there is a good reason why you have heard of many people making lakhs in share market but never many millionaire/billionaire investors like Jhunjhunwala. I have seen guys on forums earning 50-60k within few weeks & then losing similar amount in few hours so at the end of the year they are still at the same place or just a bit better financially while still holding their regular job.

Yup, I am aware about the IPOs not being an easy money. That's why I mentioned those YTers from which I get my insights. I like the funda of Invest Aaj for Kal channel:

> First see if an IPO is good enough.

> Always wait to see market response and apply on the last day (3rd day)

> If probability of market gains is good, only then apply for the IPO

> If you get a lot, sell it asap to get the listing gains.

> If you want to reinvest in that company, wait for atleast a couple quarter results.

Sadly, what happened with Burger King was a trap. And the channel fully explained how it played out like it did! (here)

I think those lost huge amounts must be dealing with F&O. I understand how risky that could be, and hence completely avoiding the same.

SBI Card ipo was satisfying all these conditions from a surface point of view(aka not deep) & still it fared badly(agree corona scare played a big role but still). Nowadays because of excess liquidity in markets all IPOs are preforming at least average but in a regular market I don't think we would have seen similar performance.> First see if an IPO is good enough.

> Always wait to see market response and apply on the last day (3rd day)

> If probability of market gains is good, only then apply for the IPO

rockfella

Ambassador of Buzz

For simple folks like us direct mutual funds + the simple concept of staying invested in the long run is the best way to go. One needs to look at the whole "time" in decades or at least 7 years. The problem with FDs is that once it matures up it stops compounding + FDs are running at such low ROI it is a joke. This is because even the banks rely on the economy. In the good days when they were giving 7/8 % things were different but even then MFs average at 12/15% so do the math. Post COVID they went down to 4/5% LOL! Thing which most of us miss is the power of compounding that shows its true nature after 10 years. This is a life long game brothers. Not a quick rich scheme.

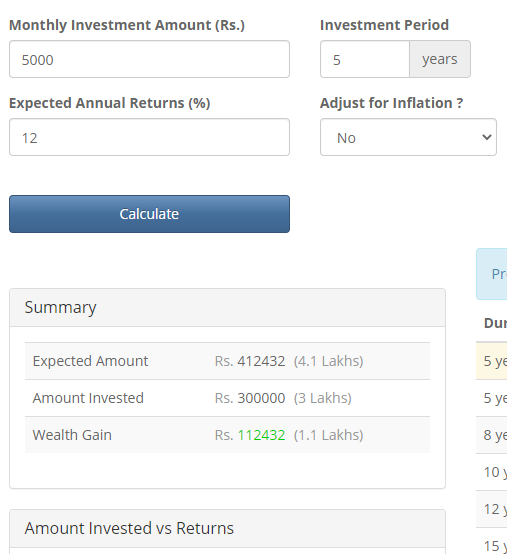

PFA :

5k SIP for 5 years @ 12 % ROI:

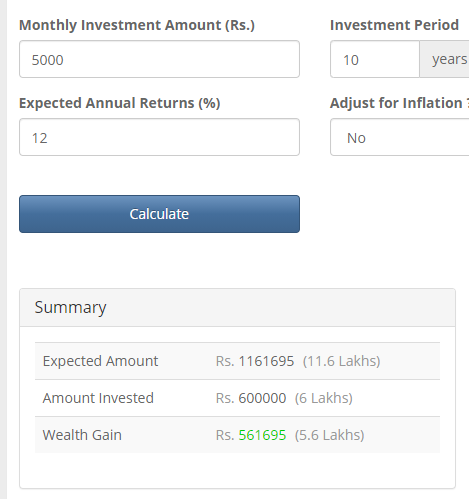

Now 5k SIP per month for 10 years @ 12 ROI:

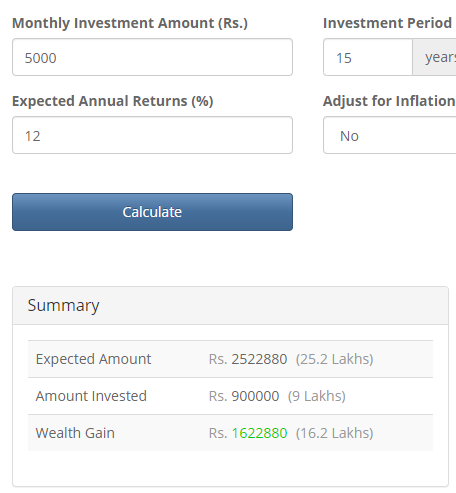

Now the same for 15 years:

See how it changes drastically after 10 years

Statistically only 2% people remain invested for more than 10 years. 98% withdraw. I don't have the source of this info but it is from a trusted source. So all the discussion we have about 7% roi for 2 years / 30 % roi for 1 year is all useless unless we think in terms of very long term. 7+ years minimum. Now apart from ELSS (It is just a mutual fund with lock in period of 36 months) you can withdraw emergency cash from any fund you like .. so your money is not really locked, but one should do this ideally if there is no other way out as whenever you will withdraw you will disturb it's compounding.

My example: I started investing in Nov 2017 in Aditya Birla and Axis ELSS almost together. In the first week of Jan 2021 I was able to withdraw approx 30k (because the transactions I made in nov dec 2017 were more than 36 months old) It not like your entire money is locked in ELSS. The lock is on each transaction or SIP for 36 months {in ELSS Funds ONLY, NO LOCK in other funds}. Since these days market is flying very high my AXIS ELSS reflects ROI of 45% (wayyyy too good but lovely hehe) and Aditya is sitting ducks at 14%. This tells me that Aditya is not really performing great despite the entire market running all time high. So my plan is to gradually withdraw from Aditya and immediately invest in Axis which is running good and will give me tax rebates as well. So you have to monitor your portfolio like this and keep on tweaking/reallocating funds .. maybe in 2/3 years time (which you will learn overtime)

IMHO Investing is a habit.. folks expect way too quick results and just give up after 3 years OR invest in shitty funds recommended to them by agents who take commission on your returns (these are called regular funds, never go regular, buy direct funds only)

Not bragging but the way market is moving ahead maybe by the end of 2021 my net gains can reach a level that I might be able to buy a 5/7 lakh car cash down. So that is like buying something from the interest one has gained from the investments. I don't know anyone who has done something like this (although many must be doing it already). I am sharing this with you guys to motivate you. Buying a brand new cars is another debatable topic

PFA :

5k SIP for 5 years @ 12 % ROI:

Now 5k SIP per month for 10 years @ 12 ROI:

Now the same for 15 years:

See how it changes drastically after 10 years

Statistically only 2% people remain invested for more than 10 years. 98% withdraw. I don't have the source of this info but it is from a trusted source. So all the discussion we have about 7% roi for 2 years / 30 % roi for 1 year is all useless unless we think in terms of very long term. 7+ years minimum. Now apart from ELSS (It is just a mutual fund with lock in period of 36 months) you can withdraw emergency cash from any fund you like .. so your money is not really locked, but one should do this ideally if there is no other way out as whenever you will withdraw you will disturb it's compounding.

My example: I started investing in Nov 2017 in Aditya Birla and Axis ELSS almost together. In the first week of Jan 2021 I was able to withdraw approx 30k (because the transactions I made in nov dec 2017 were more than 36 months old) It not like your entire money is locked in ELSS. The lock is on each transaction or SIP for 36 months {in ELSS Funds ONLY, NO LOCK in other funds}. Since these days market is flying very high my AXIS ELSS reflects ROI of 45% (wayyyy too good but lovely hehe) and Aditya is sitting ducks at 14%. This tells me that Aditya is not really performing great despite the entire market running all time high. So my plan is to gradually withdraw from Aditya and immediately invest in Axis which is running good and will give me tax rebates as well. So you have to monitor your portfolio like this and keep on tweaking/reallocating funds .. maybe in 2/3 years time (which you will learn overtime)

IMHO Investing is a habit.. folks expect way too quick results and just give up after 3 years OR invest in shitty funds recommended to them by agents who take commission on your returns (these are called regular funds, never go regular, buy direct funds only)

Not bragging but the way market is moving ahead maybe by the end of 2021 my net gains can reach a level that I might be able to buy a 5/7 lakh car cash down. So that is like buying something from the interest one has gained from the investments. I don't know anyone who has done something like this (although many must be doing it already). I am sharing this with you guys to motivate you. Buying a brand new cars is another debatable topic

Last edited:

rockfella

Ambassador of Buzz

Not exactly 30% but FD interest is taxed. Tax in MF gains come into affect after your gains go above 1 Lakh IIRC.What is that 30% charge ? Didn't read about it until now.

@rockfella nice explanation. BTW whats the website you used to show the calculation?

After 10+ years they should be similar because market cycle averages extreme highs & lows. Also sip is the only way to invest regularly, lumpsum investment is for the times when you suddenly get a big amount & have no plans of spending it as much like some big bonus in a year when there are no big purchases planned.what about lumpsum MF investment for 7+ years ? are they better than SIP ?

TheSloth

The Slowest One

What are we looking at here? and how much a financial advisor cost? Does everyone have a advisor here?This was forwarded by my financial advisor

View attachment 19915

rockfella

Ambassador of Buzz

@rockfella nice explanation. BTW whats the website you used to show the calculation?

*sipcalculator.in/

rockfella

Ambassador of Buzz

Sensex eventually comes back up and stronger. It is a direct reflection of our economy and we currently are the fastest growing large economy. Ever wondered why so many international brands want to sell everything in India? Our population/we are very impressionable : perfect to sell anything and everything. Sensible future looking smart brands know this in out. Even influencers.This was forwarded by my financial advisor

View attachment 19915

You should be doing your "financing" Don't pay any advisors