You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I only register at DSP Black Mutual Fund, and so far haven't even started an SIP. Main reason for that is since I need to plan exactly how many, amount and duration of SIPs I need. I will get to that, but since last month busy "investing" *cough* gambling in Crypto currencies.@Vyom - So did you register at Sharekhan (assuming because of the 'Khan academy')? Did you use a broker? Or direct SIP?

billubakra

Conversation Architect

I have never invested in MF's. Though my friends are getting good returns but when it comes to savings my mind doesn't allow me to take the risk, moreover if you want more returns you will have to invest your time too which I don't have.

Well I disagree. MF are the reason why people now "can" invest. You need time to invest in Shares. But MF takes it away. Every MF portfolio have someone that keeps track on them.I have never invested in MF's. Though my friends are getting good returns but when it comes to savings my mind doesn't allow me to take the risk, moreover if you want more returns you will have to invest your time too which I don't have.

That being said, MF returns took a dive since last quarter. Just today though, I got a notification from DSP black rock, that it was a correction, and that I can/should invest now in MF.

OP

Deleted member 118788

Guest

@billubakra You don't need to track mutual funds on regular basis. Every MF scheme have a proper fund manager looking after the portfolio. Just do a SIP in a equity mutual fund [will suggest a plain vanilla large cap equity fund] from respected fund houses like HDFC, ICICI, etc and track performance annually or bi-annually. My ELSS mutual funds [tax saving under section 80c] have yielded a return of 18% per annum even after this recent correction without any tracking in last 3 years. We can expect a 12-15% return over a longer time frame [let's say 10 years] without any hassle in my opinion.

You will need to give a lot of time, reading and understanding things in direct equity investment and not in MF.

You will need to give a lot of time, reading and understanding things in direct equity investment and not in MF.

OP

Deleted member 118788

Guest

Will suggest you guys to MFU Utilities to invest in Mutual Funds. Do not use any broker, bank, adviser, etc as all of them sells regular plans which are inclusive of commissions. Go for direct plan of the same scheme which will save you from paying any commission. Commission should be around 1% per annum. I know 1% does not make much difference in shorter time frame but in longer run it does.

Quoting an article from here. Mutual fund schemes: What's the difference between direct plan and regular plan?

"Take the case of a 35-year- old investor putting Rs 10 lakhs in a Regular Plan of a Mutual Fund, which grows at 8 percent a year (less 1 percent commission). When he retires at age 65, this investment would be worth Rs 76 lakhs.

On the other hand, if he switched to a Direct Plan of the exact same Mutual Fund an eliminated this 1 percent annual commission, his retirement pot would become Rs 1 crore over the same period."

Quoting an article from here. Mutual fund schemes: What's the difference between direct plan and regular plan?

"Take the case of a 35-year- old investor putting Rs 10 lakhs in a Regular Plan of a Mutual Fund, which grows at 8 percent a year (less 1 percent commission). When he retires at age 65, this investment would be worth Rs 76 lakhs.

On the other hand, if he switched to a Direct Plan of the exact same Mutual Fund an eliminated this 1 percent annual commission, his retirement pot would become Rs 1 crore over the same period."

Just a FYI for those planning to invest in MFs,you need to do a CKYC before you can invest in MFs.This CKYC is different from the KYC done by banks & will need to be done only once after which you can invest in any MF.Also Aadhaar is mandatory for investing in MF now.With Aadhaar OTP you can complete the procedure in few minutes but you will only get a limit of 50000 per MF per year.Offline CYC require submitting documents & may take anywhere from 2 weeks to 2 months(friend experience) but it has no limits for investment.

Zangetsu

I am the master of my Fate.

So interest earned is compounded annually.Quoting an article from here. Mutual fund schemes: What's the difference between direct plan and regular plan?

"Take the case of a 35-year- old investor putting Rs 10 lakhs in a Regular Plan of a Mutual Fund, which grows at 8 percent a year (less 1 percent commission). When he retires at age 65, this investment would be worth Rs 76 lakhs.

On the other hand, if he switched to a Direct Plan of the exact same Mutual Fund an eliminated this 1 percent annual commission, his retirement pot would become Rs 1 crore over the same period."

and Btw which company allows to retire at the age of 65 ? I believe its 60

OP

Deleted member 118788

Guest

So interest earned is compounded annually.

and Btw which company allows to retire at the age of 65 ? I believe its 60

Yes. Interest earned is compounded annually for the growth plans in MF. It was just an example to highlight the difference 1% can make in the long term.

Currently(but not now exactly) is the best time to play this game/invest. I recommend waiting for nifty to touch 7k & settle there though before making fresh investment.Bump. Is someone playing the Investment game? Heard it have got a recent patch "covid19" that increases it's difficulty.

That's exactly why after deferring the game for years now, that I have finally decided to start playing it.Currently(but not now exactly) is the best time to play this game/invest. I recommend waiting for nifty to touch 7k & settle there though before making fresh investment.

Today I started my research by discovering a YouTube channel that have a great host, teaching about the basics of investing in mutual fund.

*www.youtube.com/user/pranjalkamra

The game is on now!

First of all you need to decide your direction, aka direct trading or MF. I won't suggest direct trading unless willing to put in a lot of effort to learn things. Just for MF there isn't much learning involved relatively speaking.That's exactly why after deferring the game for years now, that I have finally decided to start playing it.

Today I started my research by discovering a YouTube channel that have a great host, teaching about the basics of investing in mutual fund.

*www.youtube.com/user/pranjalkamra

The game is on now!

The mutual app itself, the mutual funds, the diversification... If I want to invest some in direct stocks too, and a sandbox where I can actually invest to learn and not directly using real money...First of all you need to decide your direction, aka direct trading or MF. I won't suggest direct trading unless willing to put in a lot of effort to learn things. Just for MF there isn't much learning involved relatively speaking.

There are all that I intend to learn.

For MF you can just stick to the 4 funds(as per your requirements & funds availability) suggested in the video by Pranjal Kamra:The mutual app itself, the mutual funds, the diversification... If I want to invest some in direct stocks too, and a sandbox where I can actually invest to learn and not directly using real money...

There are all that I intend to learn.

Direct trading in stocks is much more complicated. You can check this for virtual trading.

*moneybhai.moneycontrol.com/

My advice is to don't even touch futures/options/commodity trading, never put more money than you can afford to lose in stock market & never ever think highly of yourself if you do manage to earn some good profits(knew examples where people earned 1 lakh+ based on random tips on online forums & "gut feeling" only to end up losing much more than that a few months/years later following same logic).

omega44-xt

Gear up ...

Thanks for thatFor MF you can just stick to the 4 funds(as per your requirements & funds availability) suggested in the video by Pranjal Kamra:

Direct trading in stocks is much more complicated. You can check this for virtual trading.

*moneybhai.moneycontrol.com/

My advice is to don't even touch futures/options/commodity trading, never put more money than you can afford to lose in stock market & never ever think highly of yourself if you do manage to earn some good profits(knew examples where people earned 1 lakh+ based on random tips on online forums & "gut feeling" only to end up losing much more than that a few months/years later following same logic).

I'm planning to invest as well in MFs instead of direct.

Good decision! Direct investing is much more time consuming & mentally exhausting compared to SIPs in MF. Check whether your PAN is CKYC verified here(status shown as kyc registered) & if it is then you can immediately start investing in MFs online without any limits.Thanks for that

I'm planning to invest as well in MFs instead of direct.

*www.karvykra.com/UPanSearchGlobalWithPanExempt.aspx

omega44-xt

Gear up ...

Good decision! Direct investing is much more time consuming & mentally exhausting compared to SIPs in MF. Check whether your PAN is CKYC verified here(status shown as kyc registered) & if it is then you can immediately start investing in MFs online without any limits.

*www.karvykra.com/UPanSearchGlobalWithPanExempt.aspx

That websites says Not Available.

Anyhow, I applied for an Axis demat account. A friend of mine said Axis & HDFC have good demat interface.

Then you will have to get CKYC verified first. Demat acc is mainly for share trading & is not required for MF investment except in rare cases where broker keeps MF units in demat acc(like zerodha). Don't spend too much on demat+trading acc with major names like axis,sbi,hdfc,icici,kotak because their brokerage charges are quite high & only worth it if you do a significant amount of share trades regularly. May be Axis demat acc opening procedure will get you CKYC verification too(especially if you already hold axis bank acc) but still confirm it with their customer care preferably via email. In case they confirm then register an acc on axismf & directly start sip in their Axis Blue Chip MF direct version which is mentioned in above youtube video(all MF have 2 versions: Regular(which has more commission charges) & Direct(less commission charges), all direct versions have Direct in their name but not all Regular versions have Regular in their name. Another classification is Growth version & Dividend version out of which always take Growth version only).That websites says Not Available.

Anyhow, I applied for an Axis demat account. A friend of mine said Axis & HDFC have good demat interface.

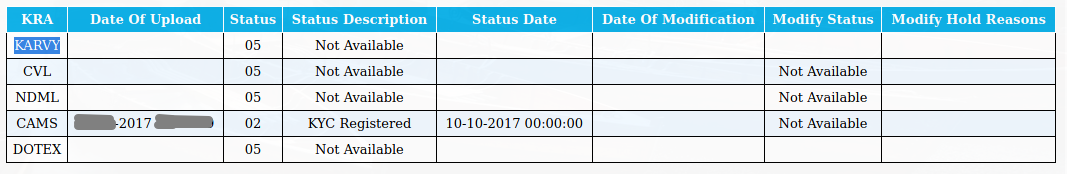

Alright, so karvykra.com shows that I am CAMS verified which I applied for in 2017 to invest in DSP Tax saver fund.

But I am not showing as verified in others:

Now, I want to know if I need to KYC verify again to invest in other mutual funds, since currently I can only invest in DSP mutual funds.

Since the site also mentions following, I shouldn't need to right?

But I am not showing as verified in others:

Now, I want to know if I need to KYC verify again to invest in other mutual funds, since currently I can only invest in DSP mutual funds.

Since the site also mentions following, I shouldn't need to right?

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc), you need not undergo the same process again when you approach another intermediary.